Moomoo Australia

When Moomoo Australia reached out to do this sponsored video collaboration, I was initially sceptical as 90% of my emails on this site tend to be spam. The name sounded funny and I wasn’t keen on covering a stock trading platform since I’m not really an investment website.

However, after some back and forth with the team, I started to do some research and realised that the company was actually legitimate. Moomoo’s parent company is Futu Holdings, a NASDAQ listed company with a market capitalisation of ~$8 billion and was recently ranked as the 2nd fasted growing company on Fortune’s 100 Fastest-Growing Companies list in 2022.

After hearing that they were planning to launch the option to invest in Hong Kong listed companies for Australian customers, I decided to take on this collab and interview Toby Wong (the Chief Operating Officer of Futu | Moomoo Australia) to find out more about the company & their motivations for expanding to Australia:

What is Futu?

If you didn’t watch the video, Futu is a digitized brokerage and wealth management platform headquartered in Hong Kong. The founder, Leaf Li, was one of the 1st employees at Chinese tech giant, Tencent, helping them build out their famous QQ messaging service:

After Tencent’s IPO in 2004, Leaf tried to invest his money but got extremely frustrated with the limited brokerage choices and the high fees they were charging. Taking the lessons his learnt from his time at Tencent (who are also the biggest investors in the platform alongside Matrix Partners & Sequoia), he founded Futu in 2011 to make the trading & investment experience easier.

With a strong technology & customer focus, they founded Moomoo in 2018, which now boasts more than 19 million users worldwide.

Is Moomoo Australia Legit? Who is it for?

Moomoo is a subsidiary of Futu and is headquartered in Silicon Valley – with many reviewers in the States often comparing them to platforms like Robinhood and Interactive Brokers.

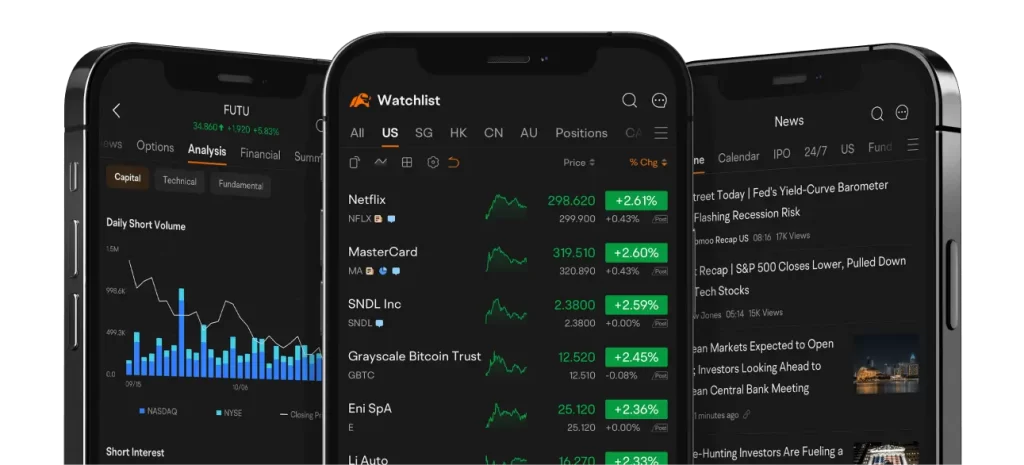

They recently expanded to Australia in early 2022 after their successful launch in Singapore in 2021. Regulated by ASIC, Moomoo Australia provides a host of free tools & insights often used by professional traders (which often cost a bomb) to make your investing experience easier.

I actually found this video interview with the founder of Futu (Leaf Li) if you want to find out more about the history & background of the company.

Who is it for?

In my personal opinion, the platform is geared more towards traders. I’m not an investment guru but the main reason I say this is because customers will not be issued an individual HIN (a Holder Identification Number that tracks your ownership of shares).

Instead, Moomoo uses a custodial model where they hold the shares on your behalf (but you are still the fully beneficial owner of the assets and will receive dividends, income and the ability to move your shares to other platforms).

The upside with this custodial model is that Moomoo can offer much lower brokerage fees and more investment options vs. other competitors – which is good for people who plan to make a large number of sophisticated transactions (see a comparison chart here). The downside is that in the unlikely event that Moomoo gets wound up, you may not have quick & easy access to your shares.

Find out more about the pros & cons of each model HERE and also check out Moomoo’s client service agreements on their website for full T&Cs. This is a personal preference depending on your investment style so make sure you do your homework!

Final Thoughts

Big thanks to the Futu/Moomoo Australia team for making this collaboration happen! It’s great to see new platforms giving consumers more choices when it comes to investment opportunities & diversification – especially Asia.

HKEX is one of the biggest & most liquid exchanges globally that not only hosts Chinese tech companies, but also a raft of “familiar” businesses like Fast Retail (parent company of Uniqlo) and Budweiser. However, would love to see the option to trade Singapore shares in the future for further diversification to SE Asia (though I’m not sure if Australians have much interest in investing in the region based on conversations with my early podcast guests).

Geopolitical tensions and global recession aside, I’m still a believer in the Asian growth story. Time will tell, but it’ll be an interesting few years to see how it all plays out in this region.